BCG surveyed 125 companies that ship cargo to gauge their willingness to pay a premium for carbon-neutral shipping. Their responses present both challenges and opportunities for the shipping industry.

Shipping is a high-carbon-emitting industry whose green transition is critical to limiting global warming in line with the Paris Agreement (less than 1.5ºC/2.7º F) by 2050). Shipping companies are already prioritizing decarbonization initiatives in their current agendas and future budgets, driven both by a wish to do their part in the global effort and by intensifying pressure from stakeholders.

Of course, as in virtually all industries, a principal hurdle is where the funding for decarbonization will come from. BCG research shows that the vast majority of shipping customers are on board to pay a premium for carbon-neutral shipping, a willingness to pay (WtP) that is growing fast. Yet the amount of the premium they will accept is insufficient to move the needle toward achieving net zero by 2050. A key question therefore remains: How can shipping companies improve their customers’ WtP, make decarbonization happen, and do it in a way that is timely, cost-effective, aligned with customer expectations, and sustainable?

As we addressed in a previous BCG report , the core drivers of decarbonization in shipping are threefold: customer and stakeholder demand, regulation, and financing—each posing its own set of challenges. In addition, three transition levers will need to be pulled to reach the target goals: operational efficiency, technical efficiency, and the application of future fuels. All three of these levers are attracting increasing attention and investment.

In search of answers and insights into shipping customers’ thinking, BCG surveyed 125 companies across industries and geographies that ship their cargo, first in 2021, and again in 2022. Their responses offer a look into their top priorities and make it clear that achieving net zero by 2050 presents not only challenges to shippers but opportunities as well.

A Growing Sense of Urgency

82% of shipping customers are willing to pay a premium for zero-carbon shipping.

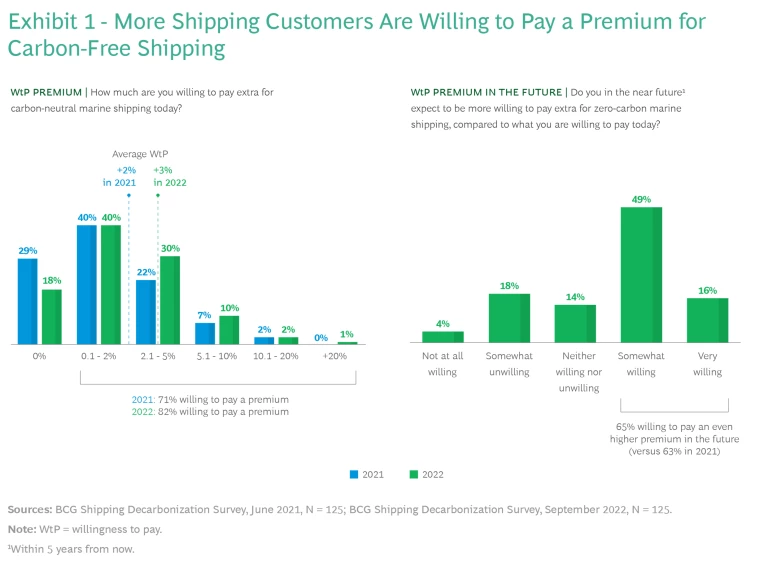

BCG’s recent 2022 survey showed that 82% of shipping customers are willing to pay a premium for zero-carbon shipping—an 11-percentage-point increase over 2021. (See Exhibit 1). In addition, the WtP premium rose by more than 30% to about 3% in 2022, which would correspond to between $10 billion and $20 billion in extra revenue for the shipping sector. A partial conversion of hesitant customers also seems to be taking place, with the low WtP segment (WtP 2%) shrinking from roughly 40% in 2021 to about 30% in 2022. Looking ahead, the trajectory of the WtP premium is positive, expected to surpass well over 3%, as roughly 65% of surveyed customers in 2022 stated a willingness to pay an even higher premium in the future. However, a WtP premium of 3% per year is not sufficient if cargo owners are to fund decarbonization alone, which would require them to pay a 10% to 15% premium per year until 2050.

In addition to increased WtP year on year, more shipping customers are responding that they would be more loyal to a zero-carbon shipper. (See Exhibit 2). Overall loyalty is higher (71% in 2022 versus 67% in 2021), with a significant shift in the low WtP segment—where only 11% of respondents were not inclined to be more loyal in 2022, compared with 20% in 2021. This higher level of commitment poses a clear opportunity for shipping companies and their customers to forge closer partnerships to share both the costs and benefits of a decarbonized value chain.

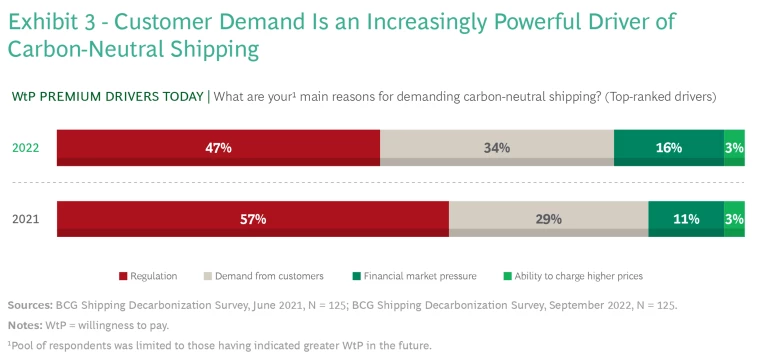

While regulation remains the most common driver of WtP premiums, demand in the shipping customers’ value chain—thus including

demand from consumers

—is playing an increasing role, rising from 29% in 2021 to 34% in 2022. (See Exhibit 3.) Such growth included an increase of more than 9 percentage points in the high WtP segment and more than 5 percentage points in the low WtP segment. This dynamic mirrors a general consumer trend, as 57% of consumers are willing to change their purchasing habits to help reduce negative environmental impact and 33% are already choosing brands that have publicly embraced environmental or social causes, according to a report by the Maersk Mc-Kinney Moller Center for Zero Carbon

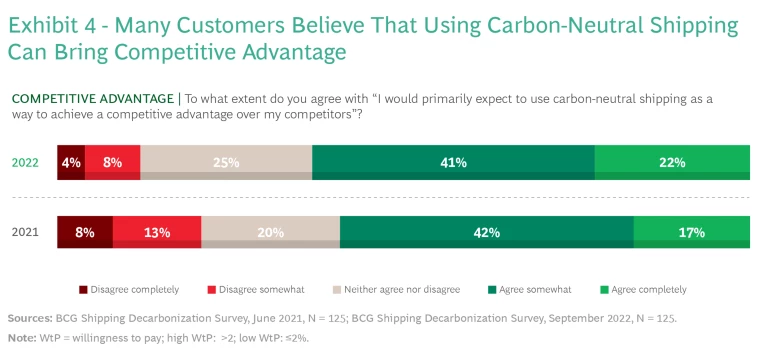

Decarbonization is being increasingly seen as a competitive asset, not just a compliance obligation—and many shipping customers expect to be commercially hurt if they don’t act.

A further driver of WtP is the notion that shipping customers stand to gain competitive advantage by using carbon-neutral shipping. In our 2022 survey, 63% of respondents believed in this principle, compared with 59% in 2021. (See Exhibit 4). In parallel, the idea that zero-carbon shipping cannot deliver a competitive advantage was believed by 21% of respondents in 2021, but only 12% in 2022. Further, a growing proportion of survey participants believe that competitive advantage driven by carbon neutrality can deliver financial benefits. Such responses indicate that decarbonization is being increasingly seen as a competitive asset, not just a compliance obligation. They also suggest that many shipping customers expect to be commercially hurt if they don’t act.

Looking ahead, the future increase in WtP is expected to be catalyzed by regulation, which will not only remain a fundamental driver but should also grow in importance. Regulatory steps taken over the past year include, among others, the European Union adding shipping emissions to its Emissions Trading System, as well as its launching of FuelEU Maritime. Further, the US proposed its Clean Shipping Act in July 2022, and Japan has publicly expressed support for a carbon tax.

Taking Action to Fill the Gap

Given that a WtP premium of 10% to 15% annually is required to fund decarbonization by 2050, it’s clear that hoping for the market to solve the funding gap "organically" by itself is not a winning approach to achieving the goals of the Paris Agreement. The current WtP growth trajectory of 30% per year will not reach the 10% threshold for years to come. It’s also evident that consumer behavior holds an increasingly vital key for closing the gap.

Taking a broader perspective, overall sustainability awareness among consumers is roughly 80%, with about 70% willing to pay a small premium (5%) for sustainable consumer products, according to the Maersk Mc-Kinney Moller Center. Fortunately, fully decarbonizing the value chain for many consumer products costs less 5% of the products’ price. For example, in a recent study coauthored by BCG and the World Economic Forum , we found the cost to be less than 2% ($1) for a $50 pair of jeans, less than 1% ($4) for a $400 electronic device, and less than 4% ($1) for a $25 shopping basket. Consequently, there is real potential to utilize consumer demand to close the gap between today’s 3% WtP premium for zero-carbon shipping and the required 10% to 15%.

Solutions to accelerate this process are already in progress. Policymakers and regulators hold a good deal of influence in facilitating change and need to move forward in instituting carbon taxes to help fund the green transition. Beyond a carbon tax, policymakers can also provide fiscal advantages for companies that adopt green solutions and support green investment and innovation. Further, they can strengthen environmental and climate-change legislation; for instance, by expanding reporting requirements.

Unlike regulators, other players in the shipping ecosystem must act through voluntary initiatives such as communication and cultural levers to realize the potential influence that consumers hold. All in all, a cooperative, combined effort will be required from regulators, shipping companies, and shipping customers as well as from financial institutions.

Within communication and cultural initiatives, we see three overall levers for achieving carbon neutrality. These include pushing for a green-positive culture, improving the perception of green offerings, and boosting overall transparency. (See Exhibit 5).

Push for a green-positive culture. Shipping companies, their customers, and financial institutions can be more forthcoming in communicating to their customers that it can be financially beneficial—as well as helpful to creating competitive advantage—to adopt green value chains. This principle is evidenced, for example, by a demonstrated lower cost of capital for firms with higher environmental, social, and governance ratings. Such players can also enter strategic partnerships to drive concrete decarbonization action. For example, banks can offer favorable interest rates to shipping companies that invest in green solutions. Further, large shipping customers can sell a green value chain to their consumers, and then partner with shipping companies by committing volumes to green shipping. Such partnerships can bolster green transition by facilitating the sharing of investments that are too large for any individual player to bear alone. Moreover, they can make the green agenda a stronger priority among companies and set an example to inspire change.

Some companies have chosen to act as frontrunners for green solutions in order to foster transition among peers and customers.

Some companies have chosen to act as frontrunners for green solutions in order to foster transition among peers and customers—not just responding to demand but increasing (green) supply to create demand and generate new infrastructure in the value chain. Nonetheless, being a frontrunner is not a requirement for taking positive decarbonization steps and starting one’s own journey.

Examples among shipping companies include Maersk, CMA, and COSCO, which have each committed to making significant investments in vessels capable of running on green methanol. And giants such as IKEA, Amazon, and other large shipping buyers have collectively committed to zero-emission shipping by 2040.

Shipping companies can also engage in the public debate to help shape the views of their customers and of policy makers—and in so doing create a seat at the table for their organizations. Further, these customers can leverage the increasing awareness and interest in sustainability issues among consumers to make decarbonized products more attractive, both through day-to-day marketing and longer-term campaigning. Increased consumer WtP for goods is expected to be highly effective for some segments, as the effect of raising prices slightly for some products (such as apparel, electronics, and consumer goods ) can help finance decarbonization.

Improve perception of green offerings. Both shipping companies and their customers should communicate the benefits—beyond reduced emissions¾of choosing green alternatives. Indeed, a BCG study showed clearly that consumers value other social and environmental topics above carbon emissions in multiple industries. Moreover, shipping companies need to understand and act on responsiveness to green products, working closely with their customers to identify what matters most to them, and determining how a premium can or cannot be obtained. A one-size-fits all approach does not work.

Clearly, the key social and environmental topics of consumers vary significantly by industry. For example, recycling and reduced waste are top-of-mind within the food, drinks, and personal-products sectors, while fair-labor practices and materials hold the most attention within fashion. Positive branding can show how little it takes of the consumer to make a sustainable choice, evidenced by another recent BCG study showing that consumers who do not buy sustainable products perceive the premium of green products as higher than it actually is—uncovering the potential value of reversing these misconceptions.

Boost transparency. Shipping companies need to confirm the impact of choosing green services compared with traditional services. This can be partly achieved, for example, through fully transparent carbon accounting and billing practices such as specifying carbon emissions on invoices and receipts. Players should also work toward creating standardized classifications for decarbonized shipping, possibly in collaboration with policymakers. Such an initiative could include fuel usage—including production emissions and measurement methods, such as well-to-wake (the sum of upstream and downstream emissions) or tank-to-wake (downstream emissions)—as well as ship classifications according to the International Maritime Organization’s Carbon Intensity Indicator.

Ultimately, decarbonization and WtP in the shipping industry is moving in the right direction. Nonetheless, the gap between current behaviors and target behaviors is still significant. To narrow and eventually close the gap, policymakers, shipping companies, shipping customers, and financial institutions must fully recognize the urgent need for action in managing and reversing climate change , taking all the necessary and cooperative steps. The stakes could not be higher—and the moment for forceful and sustainable action is now.